To eventually move the cost off the balance sheet test indefinite life intangibles at least annually for impairment which means the carrying cost of the intangible is no longer recoverable. Dispositions of intangible property.

What Are Intangible Assets Henry Horne

What Are Intangible Assets Henry Horne

Intangible assets include patents trademarks copyrights licenses and other valuable items you own but cannot physically see.

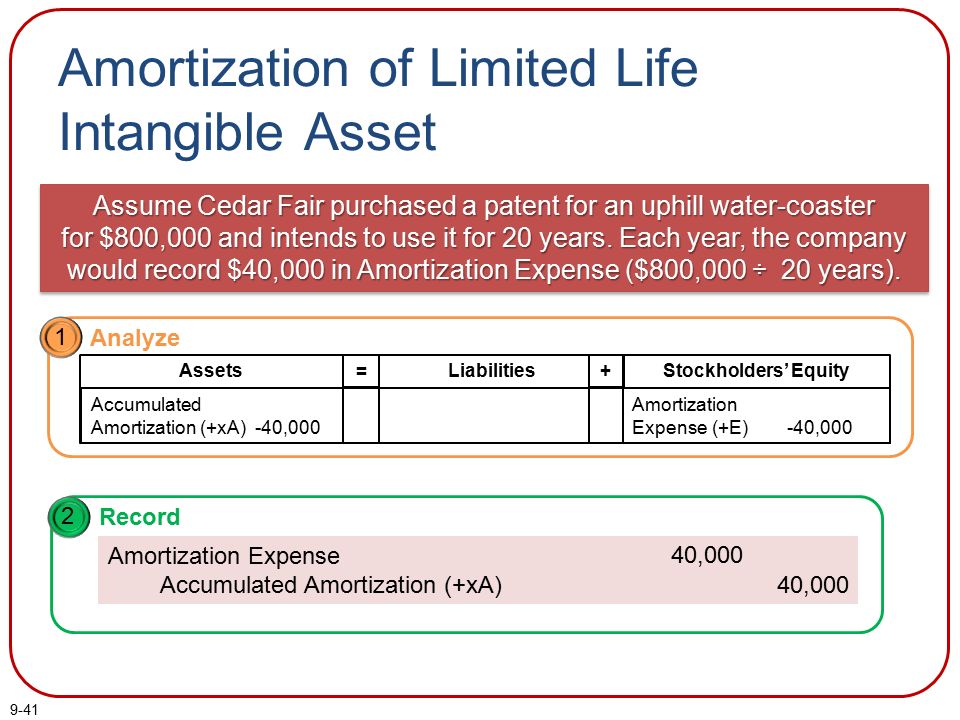

Intangible assets write off. Amortization is the systematic write off of the cost of an intangible asset to expense. Instructions for form 4797. Sales of business property.

A portion of an intangible asset s cost is allocated to each accounting period in the economic useful life of the asset. You don t amortize indefinite life intangible assets. 197 intangibles from that acquisition are written off or disposed of.

Can i write off of software and intangible assets. Share capital 8 000 retained earnings 16 500 fair value adjustment 2 000 software written off 500 26 000. Only recognized intangible assets with finite useful lives are amortized.

All intangible assets are not subject to amortization. Goodwill is an intangible asset as opposed to tangible assets such as buildings computer and office equipment and related physical goods including inventory and related forms of working. Indefinite means no factors affect how long the intangible asset will provide use to the company.

This is where it gets more complicated for sec. The finite useful life of such an asset is. An example of an intangible asset would be a patent your business purchased.

In the net assets working this is the full working of net assets but the other figures other than software written off are completely unrelated to the intangible asset write off calculation at acquisition reserves. Therefore some companies have extremely valuable assets that may not even be recorded in their asset accounts. 197 f 1 a frequently limit a taxpayer s ability to take a loss on a specific sec.

197 intangibles as the general loss disallowance rules under sec. Unlike tangible assets intangible assets are items of value your business owns that you can t physically touch. 197 intangible from a business acquisition until all sec.

What are intangible assets.